Filing an insurance claim can be stressful—especially when it gets rejected. Across Tier-1 countries like the United States, United Kingdom, Canada, and Australia, thousands of insurance claims are denied every year due to avoidable mistakes. Understanding the top reasons why insurance claims get rejected can save you time, money, and frustration.

This comprehensive guide explains the most common claim rejection reasons, real-world scenarios, and expert strategies to help ensure your insurance claim is approved smoothly—whether it involves health, car, home, travel, or life insurance.

What Does Insurance Claim Rejection Mean?

An insurance claim rejection occurs when an insurer refuses to pay part or all of the claimed amount because the request does not meet policy terms, documentation rules, or legal requirements.

Rejection doesn’t always imply fraud—many denials happen due to misunderstanding policy conditions or procedural mistakes.

Why Insurance Companies Reject Claims

Insurers assess claims based on:

- Policy wording and exclusions

- Accuracy of disclosed information

- Required documentation

- Regulatory compliance

- Fraud risk indicators

Even small errors can lead to rejection.

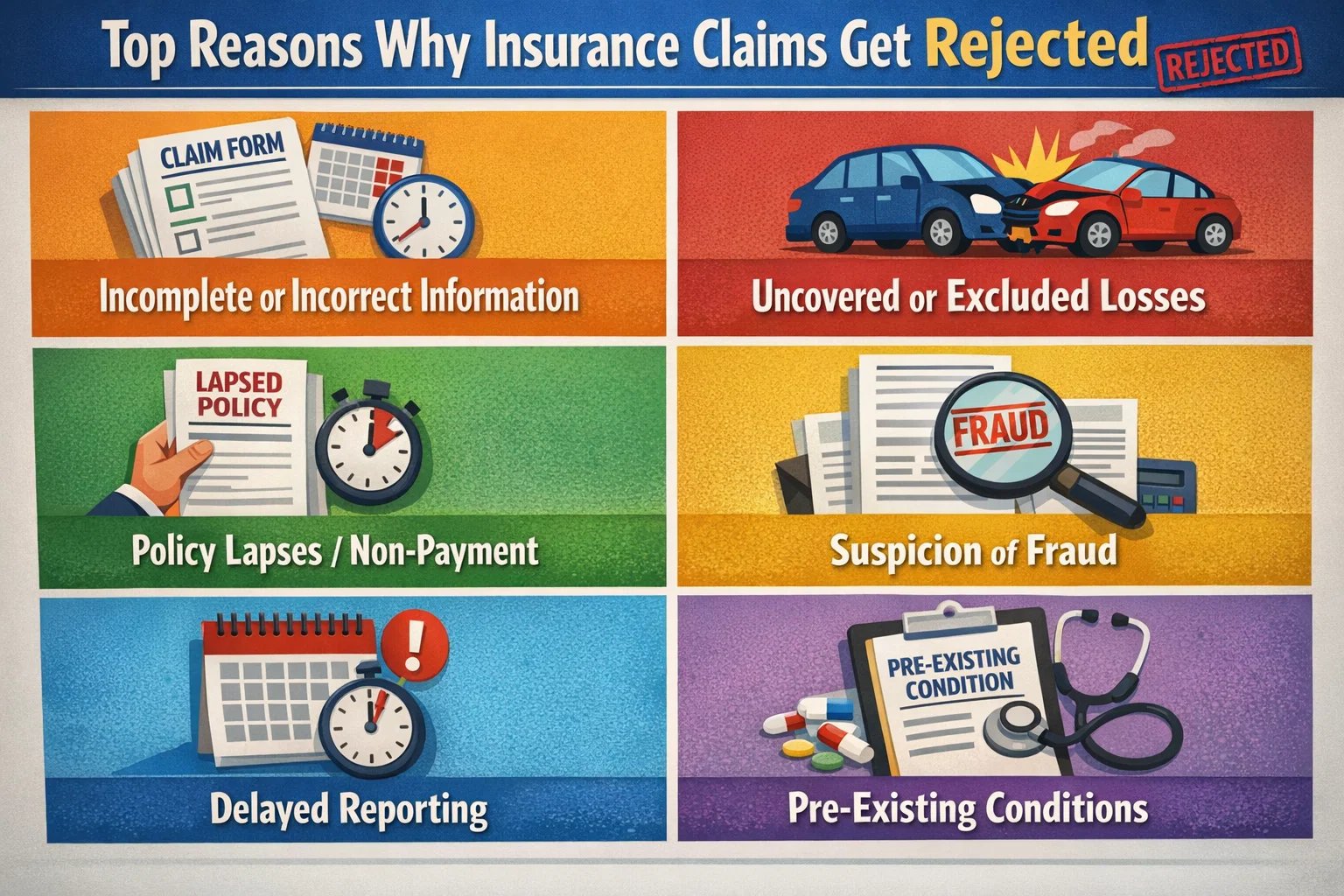

Top Reasons Why Insurance Claims Get Rejected

1. Non-Disclosure or Misrepresentation

- Undisclosed pre-existing medical conditions

- Incorrect vehicle usage details

- False income or occupation information

Insurers verify details during claim review. Any mismatch can trigger denial.

2. Policy Exclusions

Every policy excludes specific events. Common examples:

- Cosmetic treatments in health insurance

- Normal wear and tear in car insurance

- Adventure sports in travel insurance

3. Policy Lapse or Expiry

If premiums are unpaid and the policy lapses, claims are automatically rejected. Grace periods are limited in Tier-1 markets.

4. Delay in Claim Intimation

Late reporting raises suspicion and may invalidate claims.

- Car accidents: usually within 24–48 hours

- Health emergencies: during hospitalization window

- Travel incidents: immediate notification required

5. Incomplete or Incorrect Documentation

| Insurance Type | Common Missing Documents |

|---|---|

| Health Insurance | Discharge summary, medical bills |

| Car Insurance | Police report, repair estimate |

| Home Insurance | Damage photos, ownership proof |

| Travel Insurance | Delay certificates, tickets |

6. Claim Exceeds Coverage Limit

If expenses exceed policy limits, insurers may partially settle or reject the excess amount. This often occurs with:

- Hospital room rent caps

- Travel medical limits

- Underinsured home assets

7. Not Following Claim Procedure

- Using non-network hospitals

- Repairing vehicles before inspection

- Skipping prior authorization

8. Fraud or Suspicious Activity

Fake bills, staged accidents, or inflated claims result in immediate rejection and possible legal consequences. Modern insurers use AI-based fraud detection systems.

9. Waiting Period Not Completed

Claims filed during waiting periods—common in health and life insurance—are typically denied.

10. Claim for Non-Covered Person or Asset

- Unlisted insured individuals

- Unregistered property or vehicle

- Unauthorized drivers

How to Avoid Insurance Claim Rejection

- Read policy documents carefully

- Disclose all information honestly

- Keep documents organized

- Report incidents immediately

- Follow insurer-approved procedures

What to Do If Your Claim Is Rejected

- Request written rejection explanation

- Submit additional supporting documents

- File an internal appeal

- Contact the insurance ombudsman

- Seek legal advice for large claims

Claim Rejection vs Settlement Delay

Not every delay means rejection. Insurers may request verification or extra documents. Understanding this difference prevents unnecessary panic.

Final Thoughts

Most insurance claim rejections are preventable. The key is understanding your policy, staying honest, and following the correct claim procedure. With stricter scrutiny in Tier-1 countries, informed policyholders enjoy faster approvals and smoother settlements.

By avoiding these common mistakes, you greatly improve the chances that your insurance will truly protect you when it matters most.